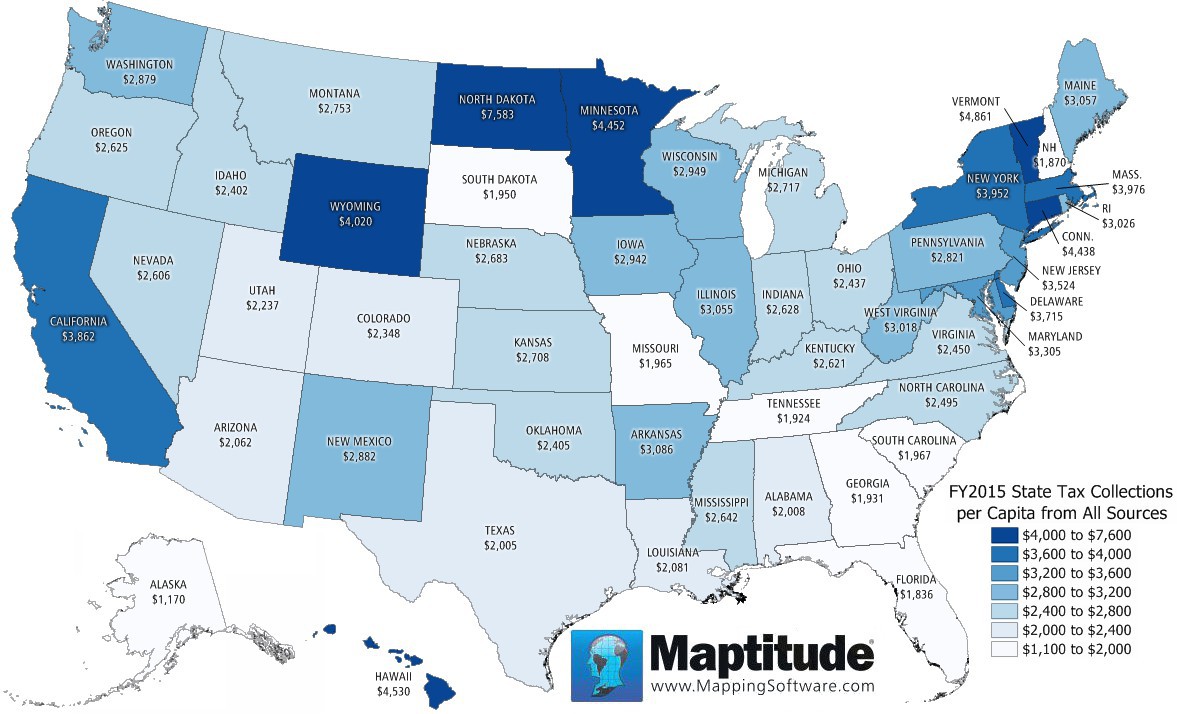

per capita taxes by state

In New Jersey on the other hand the difference is very large 13866 with a nominal per capita income of 73460 versus a real per capita income of 59594. While not a state Washington DC.

Database California Taxes Ranked Among 50 States Orange County Register

New York has the highest per capita local general revenue from its own sources at 5463 while Vermont has the lowest at 1230 per capita.

. Since 2014 EU member states have been encouraged by Eurostat the official statistics body to include some illegal activities. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. Municipalities and school districts were given the right to collect a 1000.

States use a different combination of sales income excise taxes and user. Per Capita means by head so this tax is commonly called a head tax. New Yorkers faced the highest burden with 159 percent of net product in the state going to state and local taxes.

Per Capita means by head so this tax is commonly called a head tax. Gross Collections indicates the total federal tax revenue. State government spending nationwide has grown steadily over the past two decades according to new research conducted by Americans for Tax Reform utilizing data.

This is a table of the total federal tax revenue by state federal district and territory collected by the US. It follows that as states per capita income rises its tax receipt. Distorted GDP-per-capita for tax havens.

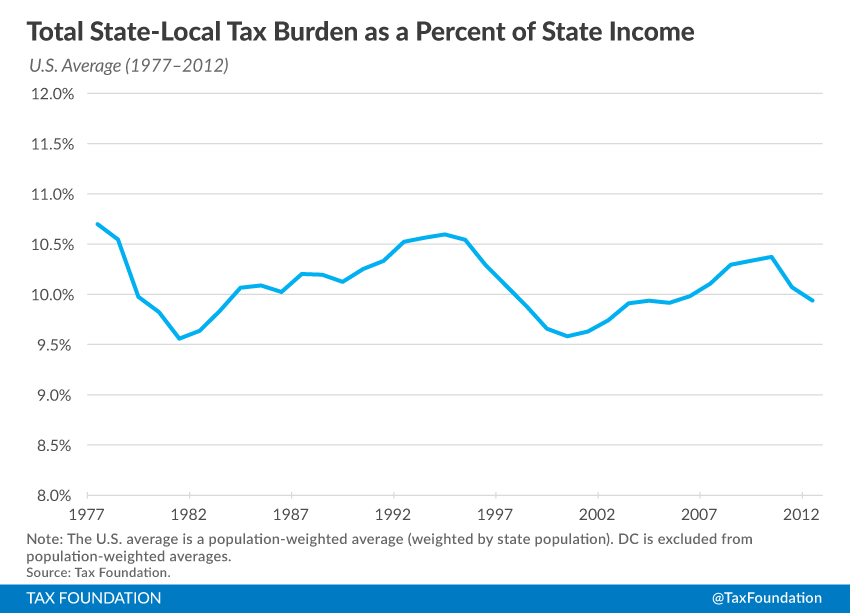

The changes in taxes have remained fairly stable over time and are strongly correlated with income per capita per state. Many taxpayers are undoubtedly wondering how this years Tax Day will. State and local government tax collections by major tax.

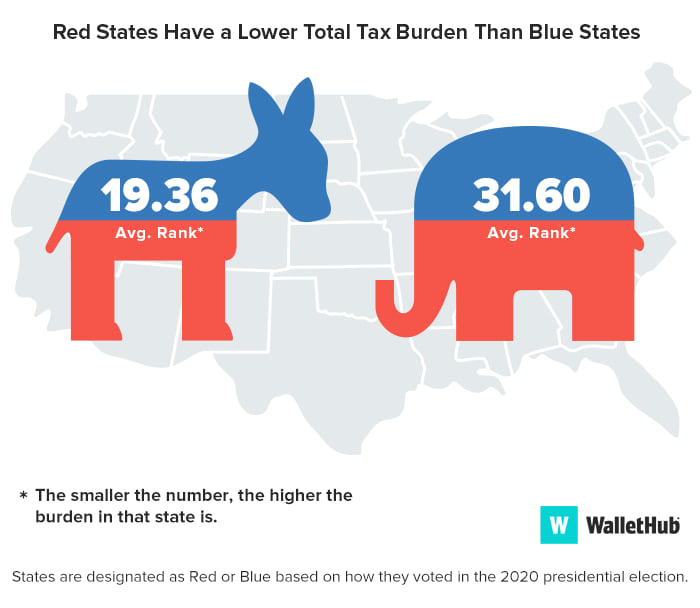

This year Uncle Sam will take his cut of the past years earnings on April 18. 211 rows State tax levels indicate both the tax burden and the services a state can afford to provide residents. The average resident of a blue state pays 9438 in federal.

Walt Disney Worlds Magic Kingdom November 11 2001 in Orlando Florida. New Jersey has the highest per. The STC provides a summary of taxes collected by state for 5 broad tax categories and up to 25 tax subcategories.

Connecticut 154 percent and Hawaii 149 percent followed. Total taxes per capita. Why do I have to pay a per capita tax.

However residents of each of the top 10 states pay 3-5 times as much in federal taxes as residents of Mississippi. Tax Burden by State. Has the highest per capita tax revenue by far at over 13000.

There are many natural. Tax revenue per capita is how much a state collects in taxes per person.

Comparing The States State Local Taxes Per 1 000 Personal Income Office Of Financial Management

Michigan Ranked 31 Nationwide For Amount Of Taxes Per Capita Drawing Detroit

Oc How Much Does The Federal Government Collect From Each State In Taxes A Comparison Between Total Contribution Vs Per Capita R Dataisbeautiful

How Do Us Taxes Compare Internationally Tax Policy Center

Vermont Is Most Heavily Taxed State In Region

Tax Foundation Washington Ranks 27th In Property Tax Burden On Owner Occupied Housing Opportunity Washington

List Of U S States And Territories By Gdp Wikipedia

Michigan Combined State And Local Tax Collections In Constant Dollars Download Scientific Diagram

State Individual Income Tax Collections Per Capita Tax Foundation

State Aid Decline Coincides With City Property Tax Increases Northstar Policy Action

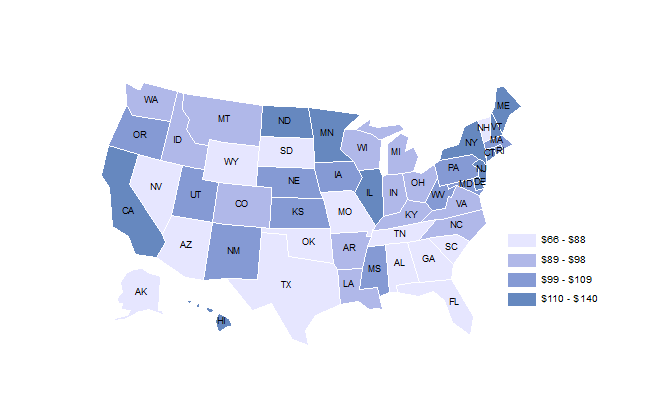

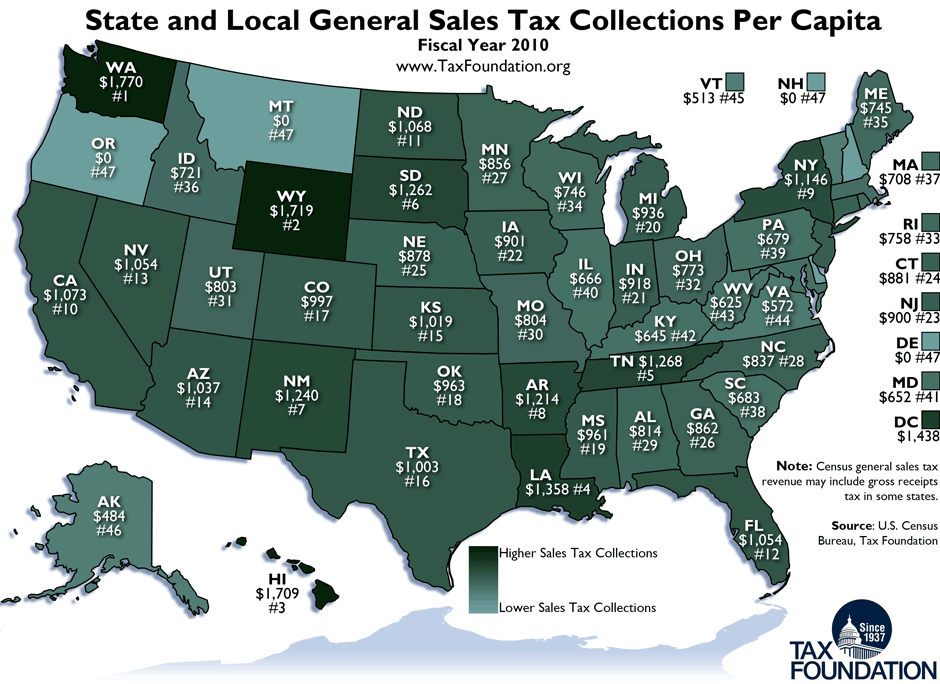

How Much Does Your State Collect In Sales Taxes Per Capita

File State And Local Taxes Per Capita By Type Png Wikimedia Commons

States With The Highest And Lowest Sales Taxes

Maptitude Map State Tax Collections

State Local Tax Burden Rankings Tax Foundation

Monday Map Sales Tax Collections Per Capita Fiscal Year 2010 Tax Foundation

States That Get The Most Federal Money Don T Mess With Taxes